On This Page

- Loan Money Safely with Lånio.dk Show more

- Banks in Denmark to Loan Money From Show more

- What Are the Loan Amounts you Can Borrow in Denmark? Show more

- What is The Cost of Getting a loan? Show more

- What Are the Different Types of Loans in Denmark?

- What Are the Pros and Cons?

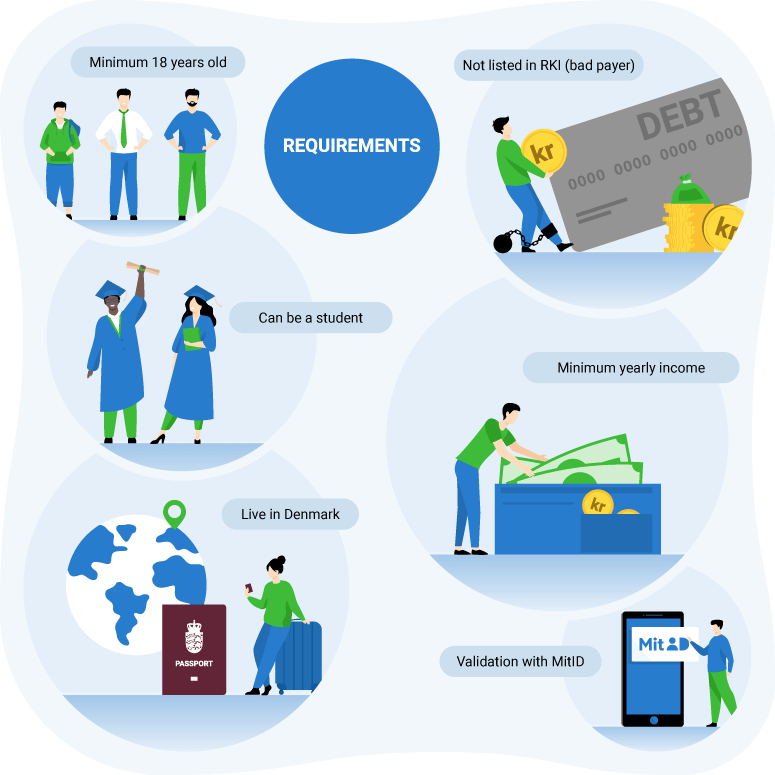

- Requirements and Terms

- Save Money and Time with Lånio.dk - A Service You Can Trust

Loan Money Safely with Lånio.dk

Searching for loans in Denmark can be overwhelming, especially for expatriates or foreigners who are not familiar with the Danish market.

At the same time, researching to identify the best offer for your specific needs could take weeks of research and exploration.

Lånio aims to save you time and money with this service. We provide a platform that integrates multiple leading banks operating in Denmark. This allows you to submit one application and receive preliminary offers from multiple banks based on the information you have shared. You will get a clear overview of your market options and the overall cost of obtaining a loan.

Getting a loan means you need to familiarise yourself with the different loan-related terms, and their Danish equivalents.

Find our list of relevant terms below:

- Interest rate = Rente

- ARP = ÅOP

- Montlhy installment = Månedlig ydelse

- Establishment fees = Etableringsgebyr

- Other fees = Andre gebyrer

- Total cost = Kreditomkostninger

- Total amount to pay back = Samlet tilbagebetaling

Our Trustpilot score indicates the satisfaction of our customers with the service. Completing the application takes no more than 5 minutes, after which you can easily access different offers for new loans and choose the most appealing one.

The service is free and there are no hidden fees in the process. Also, remember that the loan offers are non-binding.

If you have more questions, feel free to call us for quick help at 52 10 50 24.

Representative Example of a Personal Loan in Denmark

| Loan amount | 100,000 kr. |

| Loan period | 60 mo. |

| Monthly installment | 1,933 kr. - 2,309 kr. |

| Interest rate | 5.60% – 14.00% |

| Annual costs in % | 6.17% – 14.55% |

| Monthly fee | 25 kr. pr. md. |

| Total costs | 16,000 kr. – 38,555 kr. |

| Total amount to pay back | 116,000 kr. – 138,555 kr. |

Banks in Denmark to Loan Money From

At Lånio, we collaborate with multiple banks to provide you with a variety of options to choose from. To make it easier for you, we have divided the banks into three categories:

- Best banks for loans up to 25,000 kr.

- Best banks for loans from 25,000 kr. to 50,000 kr.

- Best banks for loans above 50,000 kr.

However, keep in mind that the banks categorized in one group may still offer a competitive loan regardless of your requested amount. This division is meant to inform you about the best options on average for each loan amount range.

Best Banks for Loans up to 25,000 kr.

This is the most expensive group of loans. Normally, these loans are easy to obtain, expensive in relative terms, and people pay them back in a relatively short amount of time.

- Nordcredit - Interest rate at 22.50% - ÅOP (APR) at 24.97%

- Ferratum - Interest rate at 22.52% - ÅOP (APR) at 24.99%

- Unilån - Interest rate at 16.20% - ÅOP (APR) at 19.70-24.99%

- KreditNU - Interest rate at 0.00% - ÅOP (APR) at 24.87%

Best Banks for Loans from 25,000 kr. up to 50,000 kr.

With this loan amount, you can already find some very good offers for your loan. These are the average loan amounts available. The process of obtaining them is fairly easy, and you may choose to increase the number of years you want to pay them back.

- L'easy - Interest rate at 12.55-16.90% - ÅOP (APR) at 14.73-23.50%

- SparXpress - Interest rate at 8.86-23.50% - ÅOP (APR) at 9.51-24.57%

- AcceptLån - Interest rate at 6.95-13.95% - ÅOP (APR) at 7.59-21.60%

Best Banks for Loans above 50,000 kr.

Loans above 50,000 kr. have the best terms to offer, even though they are more expensive in absolute terms. In relative terms, you can find some very competitive offers, and the banks that normally grant these loans are also more reliable and aligned with best practices.

- Express Bank* - Interest rate at 4.49-18.38% - ÅOP (APR) at 4.58-23.91%

- AcceptLån - Interest rate at 4.90-16.90% - ÅOP (APR) at 5.70-24.60%

- Resurs Bank - Interest rate at 8.86-23.5% - ÅOP (APR) at 12.81-24.99%

- Ikano Bank - Interest rate at 7.90-16.90% - ÅOP (APR) at 10.20%-19.40%

- Alisa Bank - Interest rate from 7.00% - ÅOP (APR) from 8.36%

*Siden 1. marts 2024 har Express Bank, et datterselskab af BNP Paribas Group, stoppet aktiviteter i alle skandinaviske lande, herunder det danske marked. Det betyder, at det ikke længere vil være muligt at ansøge om nye lån fra denne långiver.

Does it sound good? Apply now and see within a few minutes what are the best offers according to your profile.

What Are the Loan Amounts You Can Borrow in Denmark?

Here at Lånio.dk, you can borrow from DKK 10,000 up to DKK 400,000. However, your creditworthiness may affect the maximum amount you can borrow from a specific bank.

If a lender determines that it is too risky to grant you the requested amount, they may offer you less than what you need.

Most of the larger banks available in Denmark offer up to 400,000 kr. for individuals, while some that specialize in car loans can offer up to a million kr.

Popular Loan Amounts

What Is the Cost of Getting a Loan?

The cost of obtaining an unsecured loan in Denmark ranges from ÅOP (APR) 3.34% up to 24.99%.

Generally, the higher the loan amount and the longer the payback period, the lower the ÅOP (APR), and vice versa.

Below, we've provided two loan examples of different amounts and periods to visualize the difference in costs for larger vs. smaller loans. Although these examples are representative, please note that your final offers might differ due to individual factors and the banks' assessment.

| Loan amount | 50,000 kr. |

| Loan period | 60 mo. |

| Monthly installment | 1,020 - 1,872 kr. |

| Interest rate | 7.00% – 15.00% |

| ÅOP (APR) | 8.57% – 16.60% |

| Establishment fee | 500 kr. |

| Other fees | 25 kr. per month |

| Total costs | 11,191 – 22,094 kr. |

| Total amount to pay back | 61,191 – 72,094 kr. |

For the loan of 50,000 kr. with a term of 5 years, the interest rates offered range between 7 and 15%, resulting in monthly installments between 1,020 kr. and 1,872 kr. When the loan has been repaid, the total costs amount to 11,191 kr. to 22,094 kr., representing the price for a loan at 50,000 kr. in this example.

| Loan amount | 200,000 kr. |

| Loan period | 120 mo. |

| Monthly installment | 2,063 - 2,546 kr. |

| Interest rate | 4.00% – 9.00% |

| ÅOP (APR) | 4.49% – 9.50% |

| Establishment fee | 2,000 kr. |

| Other fees | 25 kr. per month |

| Total costs | 47,595 – 105,474 kr. |

| Total amount to pay back | 247,595 – 305,474 kr. |

A larger loan of 200,000 kr. with a term of 10 years, will most likely have a lower interest rate than the 50,000 kr. loan. In this case, it is between 4 and 9%. When the loan is paid back, the total costs will be between 47,595 and 105,474 kr. for the 200,000 kr. loan.

In principle, the cost of obtaining an unsecured loan in Denmark is relatively high compared to secured loans. This is primarily reflected in the loan's interest rate, but most importantly in the ÅOP (APR), which is the annual cost you will have to pay for the money you receive.

Obtaining an unsecured loan means that if you default on your loan, the loan provider will not be able to recoup the amount they lent to you. Defaulting on your loan also carries significant costs for you, as you will be listed in RKI, which essentially means you will no longer be creditworthy and financially free.

Therefore, here at Lånio, we always recommend thinking carefully before getting a loan. Getting on the RKI list is definitely something you should avoid, but even in this unlikely and unfortunate scenario, you can still get off. The only condition, though, is that you first have to improve your personal finances.

Check here for more information about RKI, and keep these resources handy in case you find yourself in uncontrolled debt and need free financial help.

New Law About Personal Loans in Denmark

Please keep in mind that since July 2020, a new law in DenmarkTrusted sourceFt.dkFt.dk is the official informational channel directly from the danish parliament, from where all new laws will be adopted.Go to source prohibits lenders from offering money at outrageously high interest rates. The maximum legal ÅOP (APR) that a loan provider can offer today is 25%. If you receive an offer above this percentage, do not accept the loan and report the bank immediately to the appropriate state authority.

Here at Lånio, we exclusively collaborate with banks that comply with Danish regulations. Moreover, it is important to remember that you have 14 days after receiving the money during which you have the right to change your mind and return the full amount without any fees or costs.

What Are the Different Types of Loans in Denmark?

There are several types of loans available in Denmark.

Firstly, there are secured loans which are loans, that require collateral. The most typical example of this type of loan is a house loan, where the property itself serves as collateral. This protection for the lender allows them to offer lower interest rates on your loans.

In addition to secured loans, there are several types of unsecured loans. Consumer loans are the most common type, but you can also obtain an unsecured car loan. The purpose of the loan is secondary; what matters most is your credit score in the assessment process by the loan provider.

Another type of loan is the "kassekredit", which allows you to withdraw up to a certain amount whenever you want. This is one of the most expensive loans you can obtain, so it should be avoided except in rare and urgent cases.

An alternative loan you can get is a loan with a guarantor. This type of loan is a good choice for people who do not have the best credit score. By applying together with another person they trust, customers can get approved since the guarantor helps them improve their credit score. However, it's important to note that this also carries the risk of getting the person applying with you into trouble in case you don't manage to pay back. So, don't take this aspect of the loan lightly.

Lastly, you have consolidation loans, which essentially mean a new loan designed to cover all your existing loans. This is one of the best loans you can take since it most often helps you increase your monthly left-to-live amount, which can be a great helping hand for getting your personal finances in order. Also, it helps you organize things better, since instead of having many loans from many lenders to monitor, now you have to deal with only one loan and bank.

So, all in all, this is a list of the most common loans you can get in Denmark:

- Secured loans

- Unsecured loans like "forbrugslån", "privatlån" etc.

- Consolidation loans

- Kassekredit

- Loans with a guarantor

Different Purposes for Getting a Loan

There are a variety of different reasons for getting a loan. Even though this list does not include all purposes, these are the most common reasons someone can get a loan for.

What Are the Pros and Cons?

As with everything in life, there are pros and cons to getting an unsecured loan. The most crucial one is that it is easier to get the money in your hand, but in principle, it is more expensive to pay it back.

- Get the money quickly

- Short loan process that can be completed online

- Great flexibility

- Compare multiple offers quickly and easily

- More expensive than secured loans

- You may not choose the cheapest available solution due to your lack of experience

- There is often a lack of transparency from the lenders

Requirements and Terms

You can borrow money in Denmark if you have a Danish CPR number and a "MitID" account. You must also live in Denmark and be at least 18 years old.

Of course, to be approved, you must be evaluated as creditworthy by the banks. Borrowing money without a credit rating is illegal and therefore not an option.

However, the following requirements are the most frequently used by lenders:

- Being at least 18 years old: You must be at least 18 years old. Keep in mind that some banks may require you to be 20, 21, or 23.

- You must not be listed in RKI: You must not be registered in RKI or the Debtor Register. It is difficult to borrow money if you are classified as a bad-payer.

- You must live in Denmark: You must be a resident of Denmark.

- Getting money without income: It is very difficult to be approved for a loan if you have no income. However, in very rare cases, like if you apply with a co-applicant or if you borrow with a guarantor, you may be able to be approved even if you have no income. However, here at Lånio.dk we don't recommend you get a loan if you do not have a clear way to pay it back.

- Borrow money as a student: You can borrow it if you are studying. However, this requires that you get your credit rating approved. For students, the SU-loan seems to be the most appropriate solution, since you have some of the best financial terms for paying it back.

Please note that our partners do not always request the same conditions for their customers. This means that you may receive offers from some of the banks, while being rejected by others.

Save Money and Time with Lånio.dk - A Service You Can Trust

And with that, you have the basic information you need before applying for a loan. Here at Lånio, we are proud to call ourselves the most trusted and transparent broker in the market.

Our intention is to educate, support, and offer different solutions to our users to help them make better financial decisions for their personal needs.

If you would like to see if you are eligible for a loan, simply fill out the form at the beginning of this page, and you will receive offers within the first 5 minutes.

The process is simple and free, so you do not have to commit to something in advance. In case something is unclear, or you need further help, do not hesitate to contact our customer service. We are always happy to assist you.